Taxes

If you could spend 6-12 months learning about taxes and real estate to drastically grow your net worth and retire earlier, would you do it?

The easy answer would be "of course," yet many jump straight into purchasing their forever home because of how long they have already delayed gratification.

Many physicians are in the highest tax bracket—thus, after government and state taxes are deducted, only about 60 percent is left. This may seem like a ton of money to live off right now, but once lifestyle inflation and other unforeseen factors start to appear, the comfort from your income may dwindle.

By committing even some time to learn about the strategies or topics discussed on this website, you will be in a much better spot to grow your net worth quickly and perhaps retire earlier.

While the topics discussed below come with their own challenges, familiarizing yourself with the strategies will allow you to consider them with your CPA, tax strategist, or attorney when the right time presents itself.

Foundation Knowledge

Before diving into the world of taxes, you should definitely try to get a strong understanding of passive versus non-passive income, material participation, and depreciation.

-

Income can be categorized into two buckets: passive income, and non-passive income. Activities are categorized this way because passive and non-passive income are taxed differently.

-

Material participation is when an individual is involved in a trade or business on a regular, continuous, and substantial basis.

-

Most things lose value over time—this is referred to as depreciation. In the tax world, you can claim the perceived loss in value as a loss on your taxes even though you haven’t actually lost any money. If this is confusing, read more below.

Passive vs. Non-passive Activities

Passive activities

Businesses in which the taxpayer does not materially participate

All rental activities, regardless of the extent to which a taxpayer materially participates. An exception to this is as provided under IRC Sec. 469(c)(7).

We will revisit the rule exceptions below.

Non-passive activities

Wages, salaries, commission (W2, 1099)

Stock

Crypto

Social Security

Why is it important to know the difference between passive vs. non-passive activities?

Passive and non-passive income are taxed differently

Passive activity loss rules: IRC Section 469(c)(7)

1. Passive and non-passive income are taxed differently

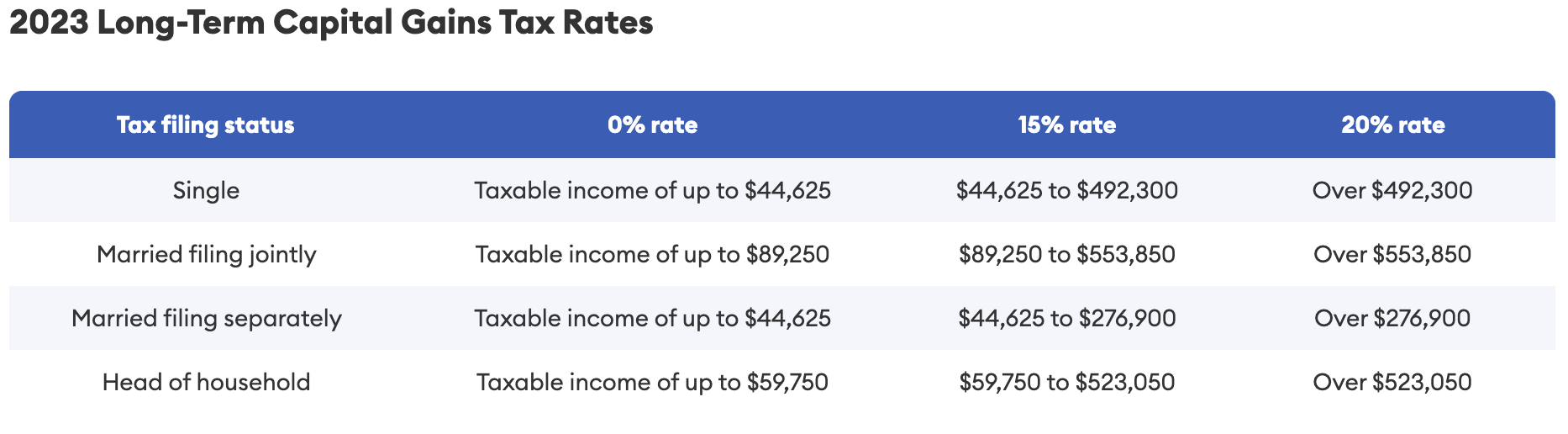

Passive income is generally taxed according to the capital gains tax rate. There are two categories of capital gains: short-term and long-term capital gains. Short-term capital gains apply to assets or investments held for less than one year and are taxed as ordinary income. Long-term capital gains apply to assets or investments held for more than one year and are taxed at the long-term capital gains tax rate.

According to Forbes, when calculating the holding period—or the amount of time you owned the asset before you sold it—you should count the day you sold the asset but not the day you bought it. For example, if you bought an asset on February 1, 2022, your holding period started on February 2, 2022, the one-year mark of ownership would fall on February 1, 2023.

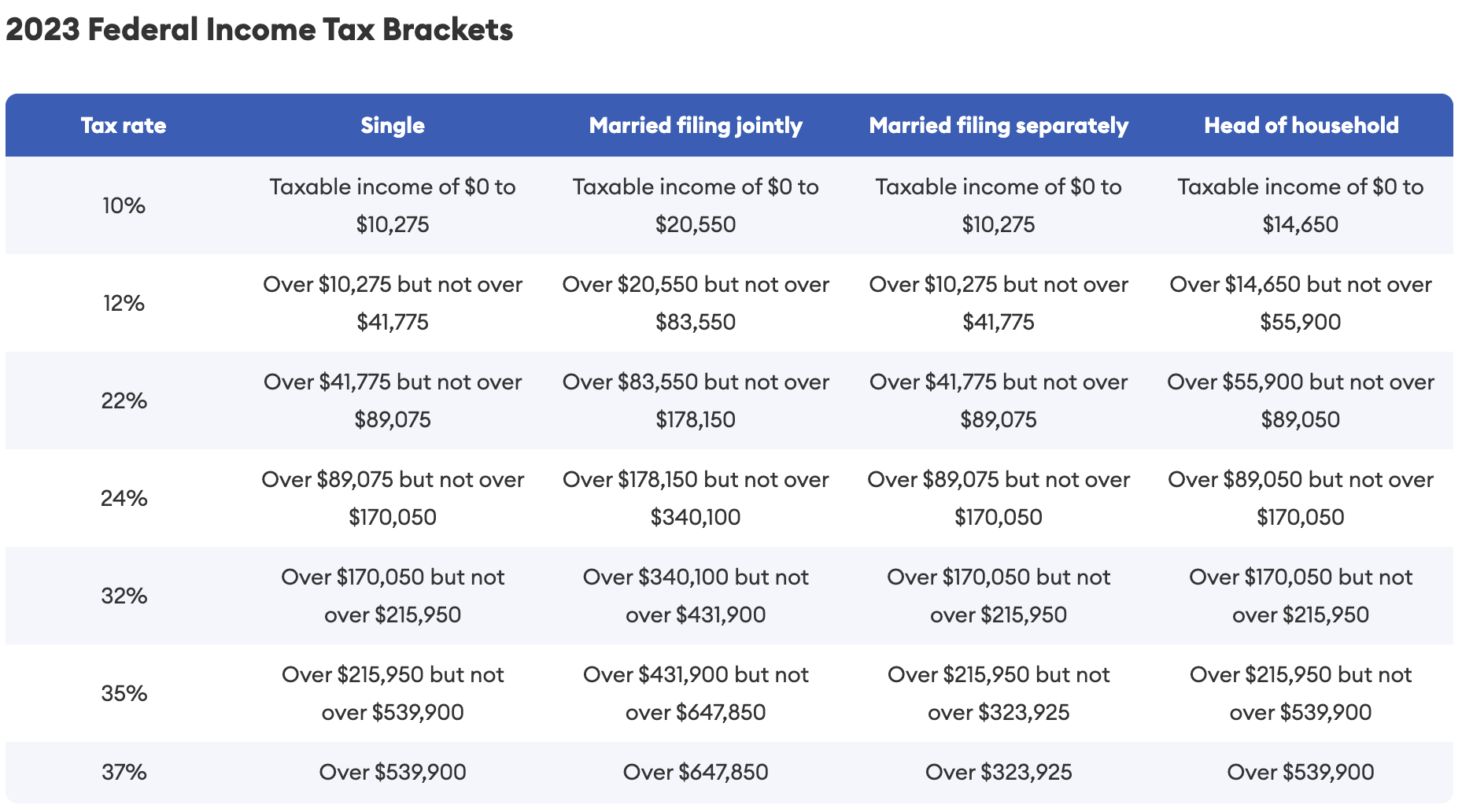

Non-passive income is generally taxed as ordinary income at the federal income marginal tax rate.

2. Passive activity rules: IRC Section 469(c)(7)

Section 469(c) says that passive activities include the following:

Any trade or business in which the taxpayer does not materially participate

All rental activities, regardless of the duration of participation, except as provided under IRC Section 469(c)(7).

There are three instances where the passive activity loss rules do not apply (listed below). In other words, you may be able to use your passive income losses to offset your non-passive income if you satisfy any of the three following requirements:

If you earn less than 150k annual gross income (AGI), actively participate, and own 10% of the rental activity, then you qualify for a loss allowance

a. If earnings are less than $100k, you can claim up to a $25k loss allowance

b. This allowance is phased out $1 for every $2 that your income increases

c. So if you are earning $120k, then $10k of the loss allowance has been phased out and your maximum loss allowance is $15k

d. Active participation is relatively easy... just need to make management decisionsOn entire disposition (i.e. upon selling your passive activity)

You are a Real Estate Professional (REP) — or, you utilize the STR loophole.

Read more: Passive Activity Loss Rules

Material Participation

What constitutes “material participation”?

Managing the property, negotiating the loan, getting the property furnished, traveling to the property to check on the Airbnb, switching items/appliances, communicating with the guests, coordinating the cleaning crew, or anything related to managing the property constitutes as material participation.

How can I materially participate in my trade or business in order to make it a non-passive activity?

There are seven (7) different ways to show material participation:

The participation is for more than 500 hours.

The participation constitutes substantially all of the participation in the activity by all individuals (including non-owners) for the tax year.

He or she participates in the activity for more than 100 hours during the tax year, and such participation is not less than the participation of any other person. (This method may be the easiest to achieve).

The activity is a significant participation activity for the tax year, and aggregate participation in all significant participation activities during the year exceeds 500 hours. A significant participation activity is one in which the taxpayer has more than 100 hours of participation during the tax year but fails to satisfy any other test for material participation.

The taxpayer has materially participated in the activity for any five of the 10 tax years immediately preceding the tax year in question. The five tax years need not be consecutive.

The taxpayer has materially participated in any three preceding years if the activity is a defined personal service activity. A personal service activity is one that involves the performance of personal services in the fields of health, law, engineering, architecture, accounting, actuarial science, performing arts, consulting or any other trade or business in which capital is not a material income-producing factor.

The taxpayer participates regularly, continuously and substantially, taking into account all facts and circumstances.

Depreciation

Depreciation is a concept that describes how the value of an asset decreases over time. There are various reasons for this decline, but the most significant one is the gradual physical deterioration of the asset as it's used. Imagine an asset like a machine or a vehicle: as it gets older and experiences wear and tear, its value goes down.

To make this easier to grasp, let's say an asset has a certain lifespan, like a number of years before it becomes too worn out and needs to be replaced. Understanding this, the IRS allows taxpayers to claim a deduction on their tax return over the expected lifespan of the asset. This deduction helps lower the amount of income that's subject to taxation.

In simpler terms, this means that even though you might have earned more money, you can report less money as your income because you're accounting for the asset's decreasing value.

In conversations about depreciation, you might also come across terms like "paper loss" or "phantom loss." These terms refer to the idea that on paper (like in your tax forms), you can show that your assets lost value even though no actual money left your bank account. It's a way to reflect the real-world decrease in value on your taxes without actually spending more money.

Read more: Publication 946 (2022), How To Depreciate Property | Internal Revenue Service

Residential real estate vs. commercial real estate

By default, the IRS allows taxpayers to depreciate residential real estate over 27.5 years and commercial real estate over 39 years. In regard to residential real estate, under this standard method of depreciation, only about 3.6% of the property may be depreciated each year for the next 27.5 years. Commercial real estate takes an even longer time to depreciate property—39 years! In the section, “Real Estate Tax Strategies,” I cover cost segregation study and bonus depreciation, which are two strategies that many investors use to accelerate depreciation and take significant tax deductions in a shorter period of time.

FAQ: Depreciation

Essentially, the IRS views depreciation as a business expense that may be deducted from your gross income in order to generate your adjusted gross income (AGI), which is then taxed. A key point to remember is that there are two different types of income–non-passive and passive income. As touched upon earlier, passive income and non-passive income are treated differently for tax purposes, so it’s important to know which type of income your business expense falls under so that you can deduct those business expenses from either your passive or non-passive income.

Depreciation Methods:

Straight line

Sum of the digits

Double declining method

Bonus depreciation

Depending on your situation, it may best benefit you to do any of the following:

Cost segregation study alone

Cost segregation study + bonus depreciation method (seems to be most common)

Cost segregation study + double declining depreciation method

Real Estate

Tax Strategies

What is a cost segregation study?

A cost segregation study is a tax deferral strategy that a company performs on a property with the goal of accelerating depreciation for greater tax deductions. In general, the study begins by separating all the individual components that make up a property from each other. After that, each component is given a lifespan of 5, 7, or 15 years. Upon filing taxes, the taxpayer may depreciate each component from his or her tax return based on the component’s given lifespan.

The following is a fake example to illustrate the above:

For example, if a couch is worth $100 and has a given lifespan of 5 years, then a taxpayer may deduct $20 from his or her gross income each year for a total of 5 years.

How much does a cost segregation study cost?

Generally, it may cost several thousand.

Should I always have a cost segregation study performed?

No. You have to evaluate your specific situation to see if it is the right decision for you.

Bonus Depreciation

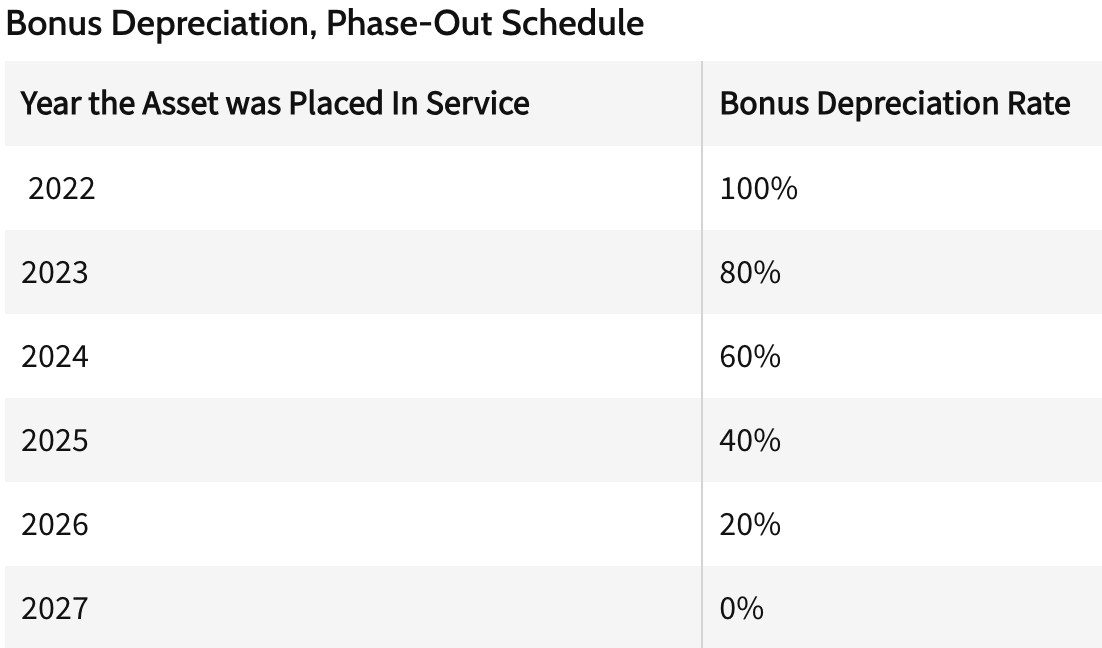

Bonus depreciation is another tax deduction strategy that allows businesses to deduct a large percentage of the cost of purchased items in the same year the item was purchased. There have been different iterations of bonus depreciation rules over the past two decades but the basic principle remains the same—bonus depreciation incentivizes small businesses to invest and helps stimulate the economy.

The Tax Cuts and Jobs Act of 2017 is the current rule in place and will completely phase out by the end of 2026.

For more details: Read here.

Question:

If bonus depreciation ends on December 31, 2026 and is not renewed, then will I be able to still get 100% deduction even if the bonus depreciation rule phases out?

Yes. Form 3115: Application for Change in Accounting Method. This form allows you to, on your current tax year, depreciate a property up to 3 years in the past. (see other articles for a better explanation).

* I am not exactly sure about this, but this is what others have mentioned. Please investigate this further. *

Depreciation Recapture

Depreciation recapture occurs when the government taxes you on the sale of an asset that was previously used to reduce one’s taxable income at the time of purchase.

When you sell or dispose of a property or asset for more than its depreciated value, the IRS requires you to "recapture" a portion of those deductions as ordinary income. This recaptured amount is taxed at your regular income tax rate, different from the typically lower capital gains rate. The remaining profit from the sale is subject to capital gains tax. Depreciation recapture rules aim to ensure fair taxation, preventing taxpayers from enjoying excessive benefits from depreciation deductions when they ultimately profit from the sale of depreciable assets.

Video explanation: Depreciation Recapture Explained [Tax Smart Daily 007]

Primary Residence

vs.

Invesetment Property

vs.

Invesetment Property

A property regarded as a primary residence does not offer the same tax deductions as a property categorized as an investment property. As you will see, those who own investment properties have access to substantial tax benefits than those who own a primary residence.

Here are some of the tax benefits of each:

Primary Residence

Property tax deduction

Mortgage interest deduction

Home office deduction (limited)

Capital gains exclusion (Section 121 Exclusion)

Generally not subject to depreciation recapture upon sale

Investment Property

Mortgage interest deduction

Property tax deduction

Home office deduction (more flexible)

Depreciation deduction

Bonus depreciation deduction

Operating expenses deduction

Capital gains tax deferral (Section 1031 Exchange)

Income not subject to FICA tax

Qualified business income deduction (Section 199A)

Rental income

Considerations when buying a primary residence:

“Buying a primary residence allows you to immediately start building equity as opposed to renting.”

False.

On a 30-year fixed mortgage, the first 10-15 years of your payments will go toward interest on the loan instead of the mortgage itself. Additionally, if the market turns sour and your home value drops below what you originally paid for the house, then you would be losing the equity in your home. If you have alrady built some equity in your home and your home significantly drops in value, all the equity you built in the home may also be evaporated.

“Interest rates may be high now but you can always refinance later.”

Not always true.

You generally cannot refinance your home if you do not have the equity to do so. If you have a conventional or FHA home loan, then you may need at least 20 percent equity to have the option to refinance.

Section 121 Exclusion

Major components of the Section 121 Exclusion:

Upon the sale of a principal residence, Section 121 allows a portion of the proceeds to be excluded from taxable income. Section 121 allows individuals to exclude a gain of up to $250,000 while couples may exclude up to $500,000.

To be eligible for the Section 121 Exclusion, the homeowner must own and use the home as his or her primary residence for at least 24 months over the last 60-month period.

A taxpayer may use this exclusion once every two years.

From the article above: “A homeowner who uses the home for business purposes, such as rental property, for part of the preceding five years would only be able to exclude a portion of the gain, however. The amount of the gain that can be excluded is determined by the proportion of time the home was used for business purposes. For a taxpayer who lived in a home for two of the five years and rented it for three of the five years, for example, three-fifths of the gain on the sale could not be excluded. That portion of the gain would be treated as income.”

What should I do if I currently own a primary residence and want to turn it into a rental property?

The premise of this strategy is to take advantage of Section 121 prior to selling your primary residence to another taxable entity. The taxable entity is an S-Corp that you set up (see the business section for more information); this entity can either be an LLC taxed as an S-corp, or a traditional corporation that makes an S selection.

Next, you will sell the primary residence at fair market value to the taxable entity, which is your S-corp. The taxable entity will agree to pay you in installments over time and perhaps also pay you now with some money as a down payment.

The sale of your property to the taxable entity gives you a step up in basis and also allows you to take advantage of the depreciation on the property’s “new” value, which is the price that the taxable entity purchased the property. So, if you decide to sell the house later in the future, you will only be responsible for paying taxes on the house’s increase in value from the price that the taxable entity purchased the house.

General steps:

Form S-Corp (The S-corp should be funded with at least 10-20% of the purchase price of the house in order to make the transaction a bona fide sale)

Installment sale

Bona fide sale

Section 121 Exclusion

If you happened to turn your primary residence into a rental property first, then you can only claim depreciation on the original purchase price of the house (versus claiming depreciation on the current value of the house in today’s market). Also, if you choose to sell the property in the future, you will be taxed on the entire house’s price increase from the cost that you originally purchased the house. In other words, you will be hit much harder with taxes at the time of sale.

Read more: What Is a Section 121 Exclusion? Definition, Example, and Basics

Video explanation: https://www.youtube.com/watch?v=8vt84Xfwx58

Section 1031 Exchange

A 1031 exchange is a rule that allows investors the ability to exchange an investment property for another “like-kind” property of equal or greater value while also deferring paying taxes on the profits from the sale.

The purchase of a replacement property occurs just like any other; however, there is a middleman known as a Qualified Intermediary who facilitates the transaction. The proceeds from the first property do not go to you but instead, go to the Qualified Intermediary. From the day of closing the sale on your original property, you have 45 days to identify a replacement or replacement property (up to 3), and 180 days to acquire a replacement property. You can identify up to three (3) replacement properties that are altogether worth up to 200 percent of the original property’s home sale price.

If you fail to acquire the replacement property within 180 days, then you will not be able to use the 1031 exchange, will be taxed on the new property, will be hit with depreciation recapture, and will have long-term capital gains.

Benefits of a 1031 exchange:

Step-up-in-basis

Claim depreciation

Claim bonus depreciation: If you use the 1031 exchange on an investment property you own, you can then claim bonus depreciation on the new property you 1031 exchanged into.

Management relief: Trade assets that require lots of time and management for other assets that are easier to maintain.

Consolidate or separate assets: You can combine multiple properties into a single property or vice versa.

Relocation: Move your assets to another location or state for reasons that may include but are not limited to retiring to another state, job relocation, favorable market conditions or lower local taxes, and local business incentives.

Deferred Exchange (this is the most common type of 1031 exchange)

A deferred exchange is when the currently owned property is sold first and then the replacement property is purchased after.

Reverse Exchange

A reverse exchange is when a property is acquired first and then the original property is sold after.

There is nuance with 1031 exchanges depending on your specific situation (especially in California), so it’s important to discuss your situation with your Qualified Intermediary.

Video: 1031 Exchange Explained: A Real Estate Strategy For Investors

Read more:

Section 121 and 1031 in Tandem

Can I convert an investment property into a primary residence while taking advantage of Section 121 exclusion and 1031 exchange?

Yes. There are nuances you need to be aware of though. Read the article below.

Reference: IRC Sections 121 and 1031 — Gain Exclusion and Deferral Riding Tandem - Boutin Jones Inc..

Real Estate Professional

A real estate professional is someone who spends the majority of his or her time in real property businesses, including the development and redevelopment, construction or reconstruction, acquisition or conversion, rental, management or operation, leasing, and brokerages.

In order to qualify as a real estate professional (REP), you must satisfy the two following requirements:

Spend 750 hours per tax year in your real property trade or business and demonstrate material participation.

Spend more than half your time in your real property trade or business and demonstrate material participation.

If you are a full-time W2 or 1099 worker, then it will be very difficult to satisfy the two REP requirements. In particular, a physician or lawyer will not be able to reasonably demonstrate that they are meeting the REP requirements.

Here is another option to consider: If your spouse is able to satisfy the requirements to be a REP, then you can both benefit from his or her REP status.

If both you and your spouse are still not able to become a REP, then what alternative strategy could you use to mitigate your W2 income tax obligations?

Short-term rental loophole strategy.

Short Term Rental Loophole

Video: What is the short-term rental tax loophole? (Cost segregations EXPLAINED)

Under IRS section 469, the government states that there are six (6) scenarios where a rental activity would not be considered passive. Here are the six exceptions to the definition of what is classified as a rental activity:

1. Customers utilize the property for no more than seven days.

2. The typical length of time a customer uses the property is 30 days or less, and the owner of the property, or someone acting on their behalf, performs substantial personal activities to make the property available for customer use. This could include amenities like daily housekeeping or meals, which hotels offer.

3. To make the property available for use, extraordinary personal services are rendered by or on behalf of the property owner (without regard to the average period of customer use).

4. The rental of such property is treated as incidental to a non-rental activity of the taxpayer.

5. The taxpayer usually lets different customers use the property during set business hours, but not exclusively.

6. The provision of the property for use in an activity conducted by a partnership, S corporation, or joint venture in which the taxpayer owns an interest is not a rental activity.

As mentioned above, short-term rentals (STRs) with average customer use of 7 days or less do NOT count as a passive activity as long as you are demonstrating material participation. Because STRs are not considered a passive activity, you can use STRs to offset your non-passive income as long as you materially participate in the short-term rental property.

Using the short-term rental real estate strategy means the following:

You do NOT need to satisfy the requirements to be a real estate professional (REP). Specifically, you do not have to spend 750 hours per year in your real property trade or business in which you materially participate, and you do not have to spend more than half your time in your real property trade or business in which you materially participate.

You STILL need to materially participate in your short-term real estate property in order to be able to use your short-term rental to offset your active income taxes (e.g. W2 income taxes).

RECAP

What are the requirements that I need to satisfy in order to use the short-term rental loophole strategy?

Satisfy any one (1) of the seven definitions for “material participation.”

If I want to rent out my rental for an average length of stay of 30 days or less, can I still use the rental deductions against my active income?

Yes, as long as you meet certain requirements.

If guests stay at your rental for an average length of stay of 30 days or less, you may still be able to classify your rental losses as active income as long as you provide services that are on par with those a hotel might offer.

Miscellaneous Q&A

If I use the STR loophole strategy with cost segregation and bonus depreciation, approximately how large of a deduction could I expect to get in the same year?

At the time of this writing in mid-2023, you can expect a 20-30 percent tax deduction. So if I purchased a $1 million property, I could potentially get a $250,000 tax deduction.

If I have multiple properties, do I have to spend 100+ hours on each property?

No. You can pool the time spent on all of your properties to meet the material participation requirement for all your properties simultaneously.

If I choose to become a Real Estate Professional, do I have to qualify for Real Estate Professional status every single year?

No. You can choose to acquire Real Estate Professional status one year but not the following year if you choose not to. (Source: Spotify Podcast “Doctors Building Wealth” ep. “Real Estate Professional Status vs Short-Term Rental Tax Loophole”)

How many properties do you need to purchase in order to utilize the REP status strategy?

Unspecified; however, purchasing more properties a year will justify two major things: 1. Having more properties will justify you spending 750 hours per year in your real property trade or business in which you materially participate, and 2. Having multiple properties (e.g. 4-6 properties) will help you generate massive paper losses to reduce your taxable active income.

What could be a starting point for physicians who are still working their normal job full time but want to get into real estate to reduce some of their taxable W2 income?

Doctors Building Wealth podcast (ep. “Real Estate Professional Status vs Short-Term Rental Tax Loophole”) says that a good starting point in his or her first year may be to purchase a property to use as a short-term rental (while simultaneously satisfying the requirements mentioned above) and continue to work full time. In the same first year, a person may also choose to purchase some long-term rentals to build up long-term rentals or cash flow. In years 2-3, he or she may choose to start cutting back some time from work (part-time or moonlighting) and acquire REP status to use REP status to offset W2 active income as opposed to the short-term rental tax loophole strategy.